Spring 2024 brought Ukrainians a lot of "tax nerves". At first, the media spread a series of high-profile news, the source of which was the government's "National Revenue Strategy until 2030", where one could find such high-profile initiatives as increasing taxes for individual entrepreneurs and introducing an excise tax on sweet drinks, including carbonated ones. And the other day, the Cabinet of Ministers submitted a bill to the Verkhovna Rada, which will radically increase the tax burden on tobacco, including electronic devices, in the next few years.

How much will a pack of cigarettes cost?

Taxation of cigarettes and other tobacco products is quite complicated. The total amount that a smoker ultimately sends to the budget for each pack consists of two separate tax ingredients: an excise tax and a so-called ad valorem rate. The first is a fixed number, the second is 12% of the cost of the pack of cigarettes itself. The difficulty is that in total, these two values cannot be less than the figure established by the tax code.

The latter, by the way, is actually an obligation of Ukraine within the framework of its European integration aspirations. Back in 2017, our country promised to gradually increase the tax burden on cigarettes to at least 90 euros per 1,000 pieces by 2025. Ukraine has never deviated from this plan and, honestly keeping its promise, has increased the excise rate by 20% every year. But parliamentarians, approving the schedule for increasing the price of cigarettes, did not take into account an important nuance: the excise rate in the Tax Code was indicated in hryvnia.

According to the plan, by 2025 the minimum total excise tax was to be increased to UAH 3,019.85 per 1,000 pieces, which was equivalent to EUR 93.2 as of 2020. But even at the current exchange rate, this figure is now only EUR 71.

So the key change that the aforementioned government bill introduces into the existing rules is the replacement of hryvnia excise rates with euro rates. In essence, the price increase plan has not changed: as before, Ukraine is to increase the amount of excise taxes on cigarettes to 90 euros per 1,000 pieces. However, and this is good news for smokers, the government has revised the schedule. So now we should reach the maximum mark not in 2025, but in 2028.

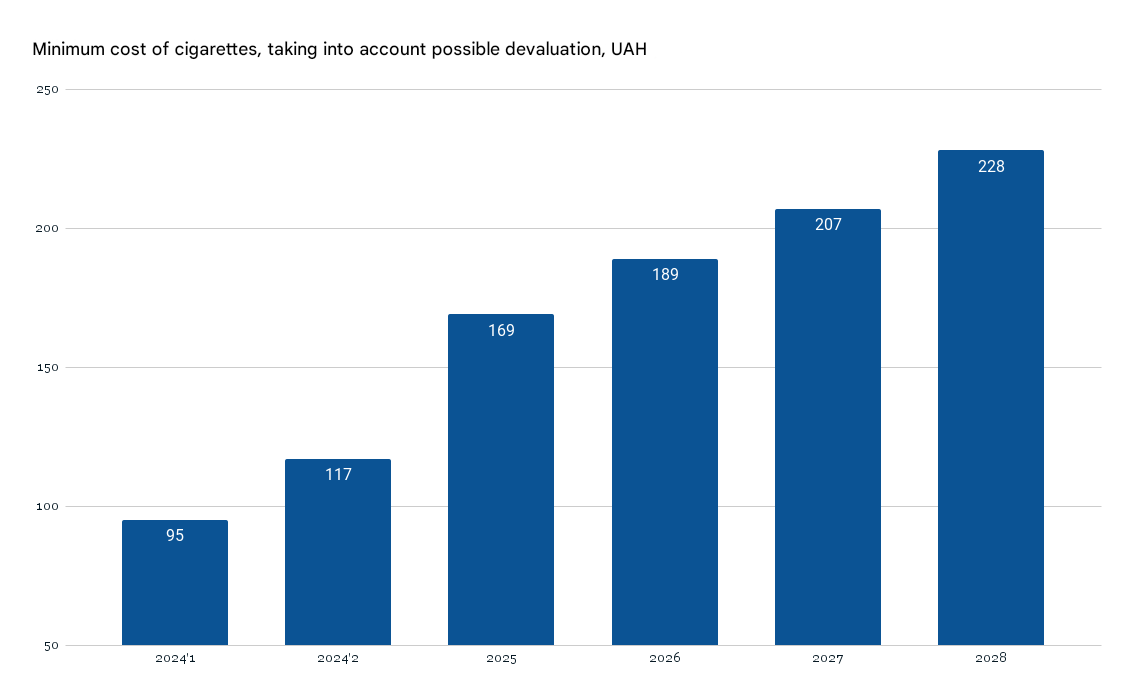

According to a simple calculation based on the hypothesis of a constant exchange rate of the hryvnia to the euro, in 2028 the minimum cost of a pack of cigarettes should be UAH 165. If we take into account the probable devaluation, taking the IMF forecast for the end of 2023 as a basis, and assuming that the euro/dollar ratio will not change, in 4 years the pack will increase in price to at least UAH 228.

Data - draft law No. 11090, IMF. Calculations - Unex Bank

The lemonade tax is much more complicated. First of all, because of the debatability of this issue. In the "Revenue Strategy", the taxation of artificially sweetened drinks is mentioned only in the context of a possible perspective. They say that in the future this issue can also be considered.

Although back in March last year, a solid group of people's deputies of over 70 people registered four relevant bills in the Rada at once. In particular, they proposed to establish an excise tax of 0.1 euros per liter of such drinks. It is not difficult to calculate that at the current exchange rate this would increase the cost of a liter bottle of the conditional "Zhyvchik" by 4 hryvnias. According to statistics, the average Ukrainian consumes 40 liters of such drinks per year, so the additional annual expenses could amount to 160 hryvnias. But for now, these initiatives remain just ideas: the most successful of the projects has only been considered by the relevant committee.

Taxes for health

But this text is not about money. It is obvious that any increase in taxes causes indignation in society. But, as it turns out, in the economic nature there are taxes that can not only earn money for the state, but also save lives. First of all, we are talking about the tobacco tax.

Few people know that France is one of the worst countries in the world in terms of smoking. The government of this country has been trying to convince the population to quit smoking for decades, but still about 35% of French people use tobacco in one form or another. Over the past 5 years, the prevalence of smoking has decreased here by only 1%. And every day about 200 citizens die from smoking - this is how the French Minister of Health described the essence of the problem last fall, when he presented another plan to overcome the tobacco epidemic. By the way, its key element is another increase in the cost of cigarettes: the minimum price here will increase from 11 euros in 2023 to 13 euros in 2025. Back in 2016, a pack in France cost 7 euros.

You may wonder why we keep raising taxes if almost doubling the price has no effect on the French people's bad habits? But scientists have an answer for that too: raising prices is the most effective way to reduce the prevalence of smoking at the population level.

Even if you've been smoking all your life, try to look at the issue of the cost of cigarettes from a different perspective. First of all, the high cost of tobacco affects not so much heavy smokers as beginners, that is, teenagers. If you don't want it, an additional 10 UAH in the price of a pack will most likely not motivate you to quit smoking. But for a 14-15-year-old boy, the difference between a pack for 80 UAH and 120 UAH is very significant.

And what about lemonade, you ask? In recent years, a lot of studies have appeared in the scientific press, proving an incredibly wide range of negative health consequences from excessive consumption of sugar, which is abundant in artificially sweetened drinks. Diabetes, cardiovascular disease, inflammatory diseases of the digestive tract, which can cause cancer, in fact, liver cancer. And this is not to mention overweight and obesity, which in themselves radically increase the risk of a number of non-communicable diseases.

Last year's modeling by German scientists showed that introducing a 20% tax on sugary drinks would save about 16 billion euros in public spending on the treatment of "sugar" diseases over the next 20 years.

And an American "field" study published in January of this year showed that a 33% increase in the price of sweet water led to a decrease in its consumption by the same 33%.

Again, the greatest impact of "price" methods of combating bad habits primarily has on teenagers, whose economic independence is very limited. And this is extremely important, since it is at this age that our lifelong habits are formed.

So, if we think not about ourselves, but about our children, might it be a good idea to increase taxes on everything harmful? By the way, the window of opportunity in this matter is not limited to alcohol, tobacco, and sugar. Last fall, Colombia became the first in the world to introduce a tax on “harmful” food – highly processed foods that are also associated with a number of serious health consequences, including cancer.