Installment, payment by installments or, as it has become fashionable to say in banking circles, BNPL (buy now pay later) is rapidly gaining popularity around the world. But to some, a short, interest-free loan for the purchase of goods seems like a global economic panacea. To others, it is a dangerous trend that will plunge young people into a debt trap.

In the spring of 2023, the Journal of Behavioral and Experimental Finance, part of the prestigious scientific publishing house Elsevier, published a joint paper by scientists from the Universities of Chicago and Nottingham, in which the authors question the safety of the entire BNPL model.

Their warnings are based on a disturbing statistic: 42% of installment payments in the United States were made using credit funds - from a credit card, overdraft or payday loan. Considering that installment purchases are most popular among young people, this financial behavior can ultimately lead to the formation of an excessive debt burden on the younger generation. Therefore, the authors of the work state that regulators should pay attention to this segment of the market, which is growing at a breakneck pace, and begin to establish rules and restrictions.

Global trend

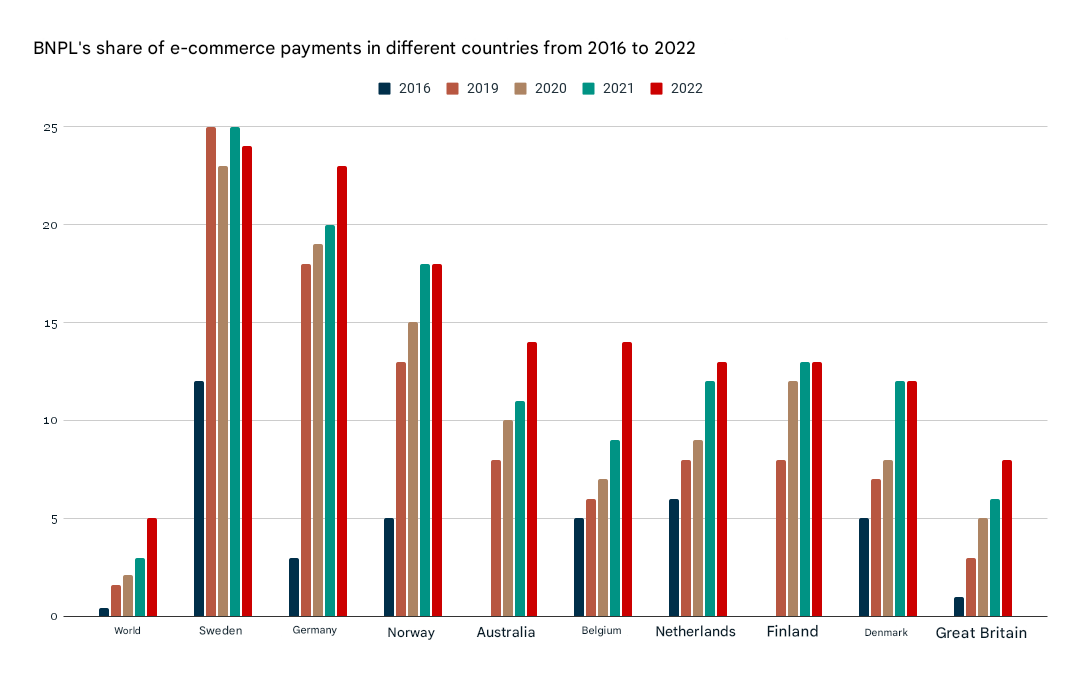

Estimates of the global interest-free installment market vary widely. For example, according to Precedence Research, the volume of this segment in 2022 amounted to over $753 billion. And in 10 years it will grow to $9.2 trillion.

Spherical Insights & Consulting cites much more modest figures, estimating the global BNPL market in 2022 at $25.4 billion with a forecast growth to $160 billion by 2032.

Data - Statista

Such a gap should not be considered extraordinary. First, the specifics of this credit model should be taken into account. Second, the regulatory features. In most countries of the world, BNPL is a de facto deregulated activity, which is mainly carried out by fintech companies that do not have a banking license. Most of them are funded by private capital. As of December 2023, researchers reported only two large companies - Affirm and Sezzle - that entered the public stock markets.

On the one hand, this makes it difficult to calculate the real size of the market, on the other hand, it creates a potential problem, which is what scientists from Chicago and Nottingham write about. The problem is that fintech companies, operating outside the framework of strict “financial” regulation, mostly ignore classic banking rules for assessing the solvency of borrowers. In many cases, they do not even transfer information about them to credit bureaus.

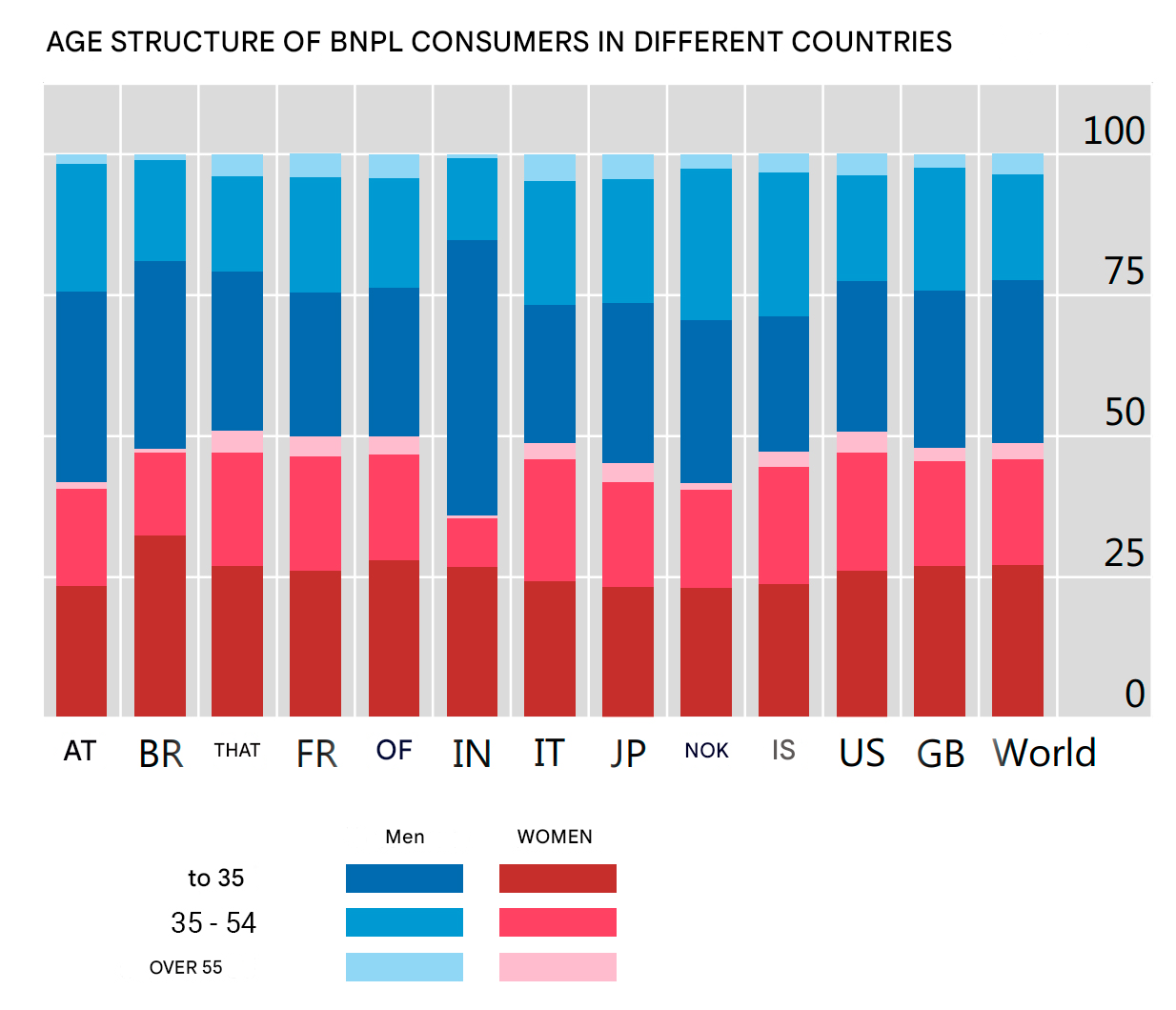

At the same time, installment purchases are most popular among young people. More than half of BNPL users are people under 35. This is the largest share among all age groups. Now remember another figure from the first part of the article – in the United States, 42% of installment payments are made using credit funds. And you will understand why scientists are so concerned about installment payments.

Data - bis.org

Is Ukraine a safe zone?

For Ukrainians, however, all the above figures and conclusions are nothing more than an interesting observation. BNPL in our country is developed by banks and individual licensed financial institutions, which are also regulated by the National Bank. In addition, the difficult economic and military-political situation forces lenders to restrain their risk appetite and increase requirements for potential borrowers. Under such conditions, one should speak more about the restrained potential for the development of the BNPL segment than about excessive indebtedness of people.

War risks and the high cost of money are far from the only problem that hinders the development of installment payment programs on the Ukrainian market. The global fashion for installment payments, triggered by the entry into the market of fintech startups like the Swedish Klarna, quickly reached our country. But the almost simultaneous entry into the market of many participants created a kind of Wild West in the segment. At least from the point of view of the average consumer.

Some banks offer customers several installment programs and even a payment in installments. Moreover, not all of them are interest-free, so they are actually ordinary consumer loans "packaged" in installments, which creates massive confusion in the minds of consumers.

And this in itself is a potential problem. Both for the development of the market and for the financial security of the borrower. It is one thing when a person takes a loan, even an expensive one, understanding its true cost. Another thing is when he is sure of the absence of commissions and interest, but behind the misleading name “installment” is hidden a loan with an annual interest rate of more than 50%.

What to do?

Both problems – both Western and Ukrainian – can be solved in different ways. The scientists mentioned at the beginning of the article transparently hint at the need for market regulation, the establishment at the state level of uniform rules for players and requirements for assessing the solvency of clients. For Ukraine, this model is hardly appropriate, since the current regulation is more than enough to fulfill the task. Especially considering the recently voted law, which limits the maximum size of the rate and should in the near future provide the market with clear requirements for assessing the solvency of the borrower.

A different path has been taken in Australia, where key market players have created the BNPL Code of Practice - a voluntary set of rules of conduct that sets out best practices and standards for BNPL providers, including providing clear and transparent information to customers, offering fair and flexible repayment options, and protecting customers from potential harm. Whether something similar should be done in our country is, of course, a purely debatable issue.

Finally, I would like to add that Unex Bank is also an active participant in the BNPL market, as it has a mono-brand installment card Med, which is a classic BNPL product. All purchases made with the card in the partner network are paid in equal installments over the following months (from one to 12). This is the most transparent installment payment program - without interest, advances, commissions and any overpayments.